👉Identity theft definition

Identity

theft is the use of someone else's personal information without permission,

typically to conduct financial transactions. By personal information, we mean

data that institutions use to recognize any individual associated with the

institutions. Examples are social security number, bank account number, address

history, and soon and so forth.

These types

of valuable information are in theory private and should be treated as SPII, but

in practice can often be discovered in a variety of ways by a dedicated

identity thief, who can then either access individual’s own accounts or open

new ones in your name. The latter practice can be particularly having a harmful effect, with just your social security number,

identity thieves can take out loans or credit cards that they never pay off —

and the resulting damage to your credit rating can be very difficult to undo.

While identity theft is a very old crime, in many ways it is a defining problem of our modern

digital age, in which your personal information can easily be exposed online

due to your own negligence or the poor security practices of companies you do business

with, and so much of your financial life rides on the accuracy of your credit

rating. The damage can be mitigated, but it's better to prevent the theft in

the first place.

Impact of identity theft on business

Identity

theft is most often associated with the act of stealing an individual's

identity.

Here we

are talking about an identity thief pretending to be someone within a company

who has the authority to make financial transactions, just like they might

pretend to be another individual.

The

consequences can be dire, particularly for small businesses where the founder's

or owner's finances are deeply entangled with the company's.

How is identity theft committed?

·

Many of these techniques would work on both individuals and businesses. Businesses are often less strict about controlling "personally" identifying information than individuals, since certain facts about businesses must be public by law, and a business is run by multiple people and lines of responsibility may be diffuse.

Identity theft examples

Once

identity thieves have identifying information about you or your company,

there's a lot of different techniques they can use to profit from it.

- Accessing existing financial accounts. This is probably the most straightforward way to

profit from identity theft-- by simply stealing your money. With a credit card

or bank account number, identity thieves can make purchases until the fraud is

noticed and the accounts frozen. Businesses, which may have large amounts of

cash or credit for day-to-day operations, are a particularly tempting target.

- Opening a fraudulent credit card or other line of

credit. This can be achieved with as little data as a name

and a social security number. Once the credit is available to the identity

thief, money can be withdrawn and spent or charges made to the card — and of

course they'll make no attempt to pay off the loan. Since the debt is attached

to the victim's social security number, there are little or no consequences for

the identity thief. Again, businesses are a particularly tempting victim of

these scams, as they can often acquire bigger lines of credit than individuals

can.

Identity

theft protection

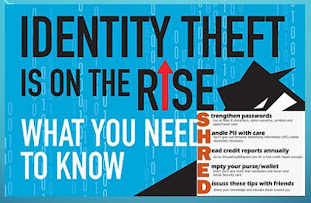

There's

a wealth of information out there on how to protect yourself from identity

theft, from outlets ranging from credit agencies to government websites to

personal finance publications. While the details differ, there are some bits of

advice that almost everyone seems to agree on, and they apply to individuals

and businesses alike.

Following

are the points we can practice to our confidential data safe from theft.

1.

Don't share personal

information (birthdate, Social Security number, or bank account number) because

someone asks for it.

2.

Pay attention to

your billing cycles. If bills or

financial statements are late, contact the sender.

3. Secure your Social

Security number (SSN). Don't carry your Social Security card in your wallet.

Only give out your SSN when necessary.

4.

Collect mail every day. Place

a hold on your mail when you are away from home for several days.

5. Store personal information in a safe place.

6. Install firewalls and virus-detection software on your home computer.

7. Create complex passwords that

identity thieves cannot guess. Change your passwords if a company that you do

business with has a breach of its databases

8. Update sharing and firewall settings when you're on a public wi-fi network. Use a virtual private network (VPN), if you use

public wi-fi.

How to report identity theft

That's

a long list of precautions you need to take, and while many people make strong

efforts to meet all of them, it's hard to do it all perfectly — and an identity

thief only needs to get lucky once. And as we've noted, many identity thieves

get personal data derived from hacks of corporate systems, so even if you've

been completely vigilant about your data, you can still find yourself a victim

of identity theft if some company you've done business with lets down its

guard.

If you think,

you have been hacked or your confidential information are compromised, here are

few tips you can follow.

1. Pull your credit report. Every year, you’re entitled to one free credit report

from each of the main credit card company You can access these reports from the

respective credit card issuer company’s website as well.

2. File a police report and fraud affidavit. These can be obtained from your creditor(s) recovery department,

and provide copies of these documents and any additional necessary paperwork to

creditors’ fraud departments.

3. Create an Identity Theft Report. Do inform the credit card issuer about the fraud

online .The online report asks a few questions about your situation, then

devises a personal recovery plan.

4. Place an extended fraud alert on your credit file. This alert lasts seven years and is available only to

identity theft victims. To get an extended fraud alert, you’ll first need to

fill out an Identity Theft Report.

5.

Make a list of suspicious activity. Applications

to open new accounts, as well as the accounts that have already been

fraudulently opened in your name, must be noted and forwarded to the three

credit bureaus and listed on your Identity Theft Report.

6.

Provide

creditors’ fraud departments with the details and contacts. It will take up to 90 days to conduct a full

investigation.

7. Obtain letters from your creditors. These letters should state that the fraudulence

on your account has been confirmed, resolved and removed from your account.

Then make sure that your creditors have expunged this negative reporting on

your account and that a letter stating this has been sent to all three credit

reporting bureaus. (As a backup, you should personally send a copy of these

letters to the credit reporting agencies as well.) Be sure to call afterward to

make sure that they have received this information.

Conclusion

Identity

theft not only impacts you financially but emotionally as well. The emotional

stress can disrupt your sleeping and eating and lead to depression. If such

things happens then giving yourself room to breathe and allowing some time to

pass to repair the damage, noting that recovering from identity theft can be a

process that takes weeks or even months.

|

| Identity Guard |

1 Comments

Today scenario personal info protection is a challenge. For more on this visithttps://www.theblog-insider.com/2020/05/data-protection.html?m=1